by Eric Salzmann | Jan 24, 2019 | Blog

I don’t mean to initiate a culture change and establish an entirely new mindset. My objective is to set up an agile environment as soon as possible ready, to implement a product in a bank. You can put together a team of business representatives, developers and possibly other people like marketing agents and so on. Everybody is super agile with the right mindset and not only preaching this, especially living this (there are still few in banking). Then it starts!

However, very soon it is “on hold”! The developer cannot install the desired open source solutions (forbidden), specifications on the UI / UX are to be allowed by the business management and the marketing projects (e.g., Grow hacking) are to be accepted in an STC, (once a month) then rolling out of a beta version can only take place, when all obligatory documentation has been approved and accepted (to be approved through more than 5 different people). However, even the finished and ready product can’t be rolled out because the management would like to present it to the board of directors (which happens once every five weeks) for the time being. A lot of time, energy and cash is lost!

How can these hurdles, disabilities, and tempo brakes be eliminated/reduced? Or even better, the pace and the drive also optimized? I identified 5 points for that. All five must be tackled. Only then, the fragile structure of an optimal agile configuration in a bank is considered a possible hierarchy.

Maximized (Workstation/place)

I do not mean to have a nice office with a punching bag, a ping-pong table, and a coffee bar. I mean a workplace that allows developers to try install/license anything immediately and independently at any time. It is a tool that needs to be installed, a firewall rule that can be bypassed or even a cloud service that wants to be used. These must be made available as quickly as possible. There is nothing more cumbersome for a developer, that to stumble in the middle of developing a supposedly optimal approach to permissions/firewall-rules or other prohibitions which can only be applied by a lengthy authorization process. Not infrequently, the work of 5 minutes, suddenly takes several days and various meetings in place.

All competencies belong to the team

All competencies have to be in the team. All of them! Architectural decisions, road map, releases, marketing, even which fruits belong in the shell. The team should/must decide what is best for them and the product. The team knows when the maturity of a product is given, how and when should a beta version go out. Not the manager or the head of corporate marketing.

The team defines, the team builds, the team takes responsibility, which means that the team decides! This promotes cohesion, performance and commitment to the product/team in multiple factors.

Courage let it go and just do it!

Last but not least, the management should be part of it. Which means, they should not be part of it! That means the management has to learn to play its part in this agile setup and hand over into the skills and the trust of their team. There is no guarantee that it will work without error, but the certainty of making mistakes as soon as possible and adapt them as quickly as possible. The team needs the support of the management in the form of trust and room for maneuver: no micromanagement, no overhead controls, no weekly budget controls. The management can always get an idea in review meetings (passive participation). The administration has to let the team do it.

Guidelines should help, not prevent

Needless to say, the team needs to create a framework. The most important rule “The guidelines should help the team to focus on the solution!” Leaving all freedom to the team can be counterproductive. The team can lose themselves and possibly even have opposite views of the product. The assignment to the group must be clear but not limiting. It is a tightrope walk, not to restrict the team too much but still give certain strokes to its creativity and their power. For example, the team must be aware of the regulatory limitations. Also, the requirements of the security must be made clear to the team. However, what does not work are already existing technologies and platforms of the bank as guidelines. There must be the idea to make recommendations or references to existing environments/products/platforms/software. Mostly, the instructions should help the team to find each other and create a general understanding of what the goal is. As I said before, this is a very delicate topic that is a bit tricky in its formulation.

Management Expectation

Management must realize that an agile setup doesn’t necessarily have to be cheaper. This must not save cost in the short term. There is a tendency that the prices can even increase in the short term. However, it is crucial to the management to clearly show that the set-up allows, that the product is developed and adapted much faster (market influence, technological influence) in compliance with the rules (can be maintained in working agreements). Thus, the product is also faster on the market (time to market). Considering these factors in terms of costs, it quickly becomes clear that the bottom line is that they are usually even lower than before. It must be clearly stated what management can expect based on its setup, plans, and rules.

In that sense… Don’t wait! Do it!

by Eric Salzmann | Aug 31, 2018 | Blog

What does a bank do if it does not longer moving forward? What when the time comes and there is no internal solution as prospect? It summons one of the Big Four. PWC, Deloitte, KPMG, EY maybe also Mc-Kinsey. Without doubt, these firms truly stand for competence, with their wealth of experience and a wide network. They are often perceived as THE experts and also quite frequently as the saviors. This might be absolutely correct, considering the challenges in the traditional and “old” financial ecosystem.

When it comes to digitization, however, they present similar problems as the banks. Highly-qualified personnel, in the fields of Fintech, Regtec, Martech, x-tech, is difficult to recruit. The knowledge in these areas is temporally very limited, fast-paced and, not least, also exposed to other cultural environments. In certain situations, others rules than the ones known by you might apply.

Again, a situation has been made known to me, which has occurred several times in other constellations. A medium-sized financial institution has asked one of the Big Four about Blockchain. Of course, the Institute has recommended hisself for the blockchain topic, and assures to have appropriate expert knowledge. One would never admit being unable to provide adequate expertise.

Thus, the contract was granted, on the other hand accepted. After about 4 months with a lot of PowerPoint slides and high bills, they has realized that the know-how was not enough. That’s why they hired a blockchain fintech. Thus, the actual project could start 4 months and several CHF 10,000 later. The consulting institute earned the cash, but the services was provided by the fintech.

Bad, expensive and it does not have to be the case. These consulting firms lack in the digital area, what banks are also missing. The access to the new ecosystems. Fintech, startups, talents, network, tech know-how, access to generation X, Y and Z and many more. This is not something one is denied per se. However, the above-mentioned are not available in the known networks, processes or partnerships.

The financial institutes, for the most part, have not found any point of access to these “new” ecosystem. The big consulting firms have, in general, one-sided interests and therefore rarely partner with fintechs.

Do they not want them or do they not know how? From my own experience, I can confirm that digital projects in the “old”, cumbersome but long very successful ecosystem of the financial industry need many times more time and money. Moreover, from a qualitative point of view, the result rarely meets the requirements (internally as well as externally). With the exploitation of the new ecosystem, financial digital knowledge, the network, the diverse agile project setups as well as their culture and closeness to the digital generation become accessible.

It is time for the financial institutes to open up to this ecosystem. Fintech and startups receive the financial institutes with open arms. They rely on partnerships and collaborations. And the fear that certain services could be divested by the banks is less likely if the bank is part of that ecosystem than to continue to move outside.

All that remains is to convince the management that the implementation of digital solutions at a lower price in less time is better than a PowerPoint marathon with renowned big consulting institutes and their own top management.

by ndwr | Aug 28, 2018 | Blog

Post von Crealogix

Hallo Patrick, schön, dass wir uns mal wieder sehen.

Du bist Gast-Referent bei unserem API-Economy Digital Banking Breakfast am 27.07.2017 in Zürich. Dr. Sandra Daub wird über Open API Banking – vom Traum zur Wirklichkeit sprechen und Dr. Nico Tschanz über Geschäftsmodelle der API-Economy für Banken.

Was erzählst du unseren Gästen?

Ich möchte natürlich noch nicht alles verraten – nur so viel. Ob all dem Buzzword-Hype und den digitalen Bedrohungsszenarien in den Medien sollten wir nicht vergessen, was uns als Unternehmen und Branche eigentlich ausmacht. Über API-Economy konkret werden Nico und Sandra sprechen.

Welches konkrete Thema beschäftigt dich aktuell am meisten?

Ich beschäftige mich intensiv mit der Frage, wie in etablierten Branchen wie der Finanzindustrie über Kooperation und Kollaboration Ecosysteme gezimmert werden, die kundenrelevante Innovation hervorbringen, die sich monetarisieren lässt.

Du sprichst in deinem Vortrag auch über das Silicon Valey.

Worum gehts?

In Zusammenarbeit mit CREALOGIX und Fintechrockers wollen wir einem kleinen Kreis von MachernInnen aus der Finanzindustrie eine Plattform bieten, ihre digitalen Initiativen einem konstruktiv-kritischen Reality-Check zu unterziehen. Das intensive aber abwechslungsreiche Programm beginnt in der Heimat mit einer Briefing-Session, wo erfahrene Crealogen individuell mit den TeilnehmerInnen die Schwerpunkte der Reise ausloten und quasi ‚den Schwamm anfeuchten’. Ein feuchter Schwamm saugt besser als ein trockener, wie wir aus der Physik wissen.

In Zusammenarbeit mit CREALOGIX und Fintechrockers wollen wir einem kleinen Kreis von MachernInnen aus der Finanzindustrie eine Plattform bieten, ihre digitalen Initiativen einem konstruktiv-kritischen Reality-Check zu unterziehen. Das intensive aber abwechslungsreiche Programm beginnt in der Heimat mit einer Briefing-Session, wo erfahrene Crealogen individuell mit den TeilnehmerInnen die Schwerpunkte der Reise ausloten und quasi ‚den Schwamm anfeuchten’. Ein feuchter Schwamm saugt besser als ein trockener, wie wir aus der Physik wissen.

Nach der Rückkehr aus dem Valley verarbeiten Crealogen & Fintechrockers die Learnings gemeinsam mit den TeilnehmerInnen in Form eines wiederum individuellen Pitch-Decks mit Handlungsfeldern, damit die Fülle an Eindrücken aktiv zu den anderen Entscheidungsträgern im Unternehmen gelangt. Diese Kombination von Inspiration, Learning und actionable Insights ist in dieser komprimierten Form einzigartig.

Kontakt für dieses Programm ist Dr. Nico Tschanz.

Fintechrockers gefällt mir natürlich besonders gut.

Welche Playlist hörst du diese Woche?

Meine eigene Jogging-Playlist – sie erinnert mich (schmerzhaft) daran, dass ich mit meinen Vorsätzen auch dieses Jahr schwer im Hintertreffen liege…

Kannst du deine aktuelle Job-Bezeichnung kurz erklären?

Ich trage aktuell 3 Hüte. Am Institute for Digital Business der HWZ Hochschule für Wirtschaft betreue ich als Studienleiter von zwei CAS Lehrgängen u.a. Masterstudenten in den Programmen ‚Digital Leadership’ und ‚Digital Masterclass’. Da bin ich mehrere Wochen im Jahr in den digitalen Metropolen London, Berlin und San Francisco / Silicon Valley, wo ich Bootcamp-Studienreisen für Führungskräfte und digitale Talente begleite.

Bei Fintechrockers, einer Gruppe von Mit- und Vordenkern für den digitalen Wandel in der Finanzindustrie, bin ich Vorstandsmitglied. Wir haben Ziel, den nicht zwischen Lethargie und Innovationstheater pendelnden digitalen Initiativen hiesiger Institute eine Plattform zu bieten. Als rebellischer Gegenentwurf sozusagen.

Und ich teile ich mein Wissen (und die gesammelten Irrtümer) als Keynote Speaker und Senior-Berater bei Carpathia Digital Business.

Welches Zitat ist typisch für dich?

Don’t let today’s opportunities be tomorrow’s what ifs.

Dankeschön, Patrick, wir freuen uns auf deinen Vortrag.

Es sind noch ein paar wenige Plätze frei. Zur Anmeldung Digital Banking Breakfast in Zürich am 27.7.2017.

by ndwr | Feb 28, 2018 | Blog

Swiss national blockchain and cryptocurrency

Download the Exposé (EN,DE)

Purpose

This exposé aims to motivate a broader dialogue in establishing a Swiss decentralized, robust, and energy-efficient blockchain infrastructure as the underlying foundation for a strong, growing Swiss digital economy. Such blockchain infrastructure, carried jointly by all Swiss cantons, will have an equivalent catalyst effect as the initial introduction of the railway system or the creation of the Gotthard tunnel during the age of industrialization. The Swiss national blockchain will enable local as well as foreign entities and all people with an interest and/or business relation with Switzerland to hold genuine Swiss cryptocurrency and/or execute transactions via legal compliant smart-contracts. The introduction of Swiss cryptocurrency “Crypto Franc”, bound to the issued fiat Swiss Franc by the Swiss National Bank (SNB), revolutionizing digital payment capabilities. The national blockchain will enable and bring the Swiss industry(s) to the international forefront of the digital age.

Benefits for Switzerland

The introduction of a national blockchain and corresponding cryptocurrency brings significant and multifaceted benefits required for a modern digital economy. Switzerland will become part of a group of leading digital nations, with blockchain and cryptocurrency bringing the Swiss market to new efficiency levels. This initiative will attract knowledge and engineering skills further strengthening the position of Switzerland as a leading innovation economy. Blockchain technology will become a game changer and a catalyst to future phase(s) of digital financial and business product innovation via stable, legal, and economical technology facilitated by smart contracts.

Suggested Set-up

The Crypto Franc will be implemented as a cryptocurrency on a hybrid blockchain. While the chain is open for all to participate there will be permissioned nodes federated via all Swiss Cantons using the consensus mechanism, which guarantees adherence to the rules and regulations defined by the Swiss regulator. The Blockchain protocol will focus on low energy usage, high throughput, security and stability. It allows deployment of smart contracts that can be used for a large variety of business and e-government purposes. In addition, the Swiss National Bank (SNB) guarantees the exchange of Swiss Francs against a Crypto Franc 1-to-1, i.e. the a Crypto Franc is pegged to the Swiss Franc.

Exhibit 1: Blockchain nodes in Switzerland for the Swiss a Crypto Franc?

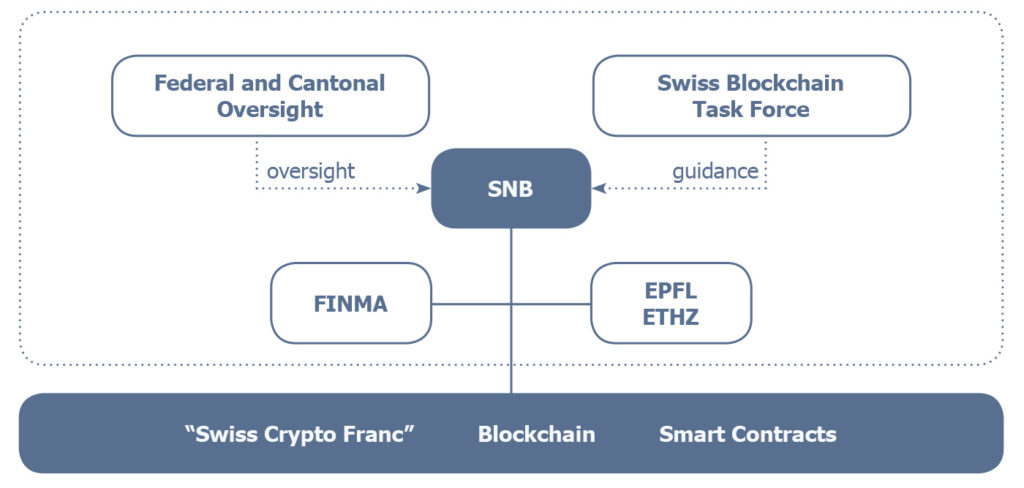

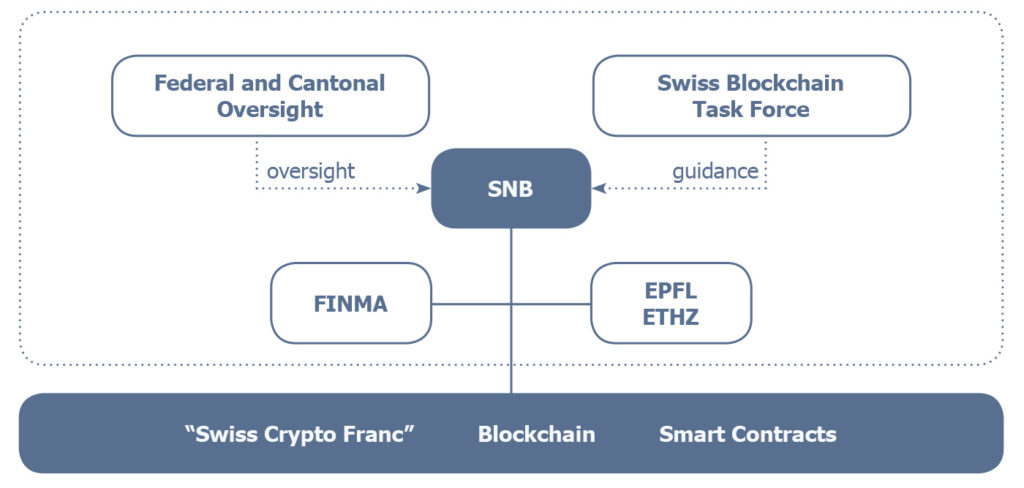

Governance

The SNB is the only a node on the Blockchain which can create new a Crypto Francs or retract them from the markets, therefore having full control to the liquidity of a Crypto Franc. The protocol to sustain the Blockchain is created by a dedicated working group, comprising of a specialist team from EPFL and ETHZ. The code is open but owned and governed by the SNB, in collaboration with the dedicated developer team. FINMA will continue to safeguard required regulatory and prudential measures, e.g., on onboarding and preventing market abuse. These measures will be implemented directly by the blockchain. This hinders the execution of business violating the rules and regulations simplifying market oversight and reporting.

Exhibit 2: Governance framework for the Swiss national Blockchain and the a Crypto Franc?

A national task force (e.g., the Blockchain Task Force recently initiated by BR Schneider-Ammann and BR Maurer) with representatives from government, business and industry and technical associations will provide advisory and guidance during the deployment of the Blockchain and national cryptocurrency. Federal and cantonal political entities will continue to monitor progress and provide the required political framework and stability around the blockchain.

Summary and Outlook

As railways and electricity were the base for the age of industrialization, the Swiss, centrally governed, but federated blockchain is the foundation for the information age. It will with minimal effort accelerate the Swiss economy and bring our innovation capabilities to the forefront. The Crypto Franc and the Swiss Blockchain will serve as the enablement for a prosperous healthy financial industry with advanced governmental systems, incl. e-Government, national digital identities and distributed ledgers, helping our nation to adapt to the challenges of the digital age.

Download the Exposé (EN,DE)

by Eric Salzmann | Nov 3, 2017 | Blog

How can digital transformation be effected in a bank as quickly and as painlessly as possible? This is a question that occupies the thoughts of some banks more than others.

Some take the view that this is all “overhyped” and favour a “drink tea and wait” strategy. Others try to deal with this topic by appointing a Chief Digital Officer (CDO) or Chief Innovation Officer (CIO) and believe that they have landed a big coup. Yet others try to implement the future by burying projects beneath external contractors and are amazed when their own staff struggle because they have no understanding of it. And then there are those that hope to bring digitization in-house via developing PoC (proof of concept) with fintech and/or start-ups.

These models result in expensive and, at best, minimal digitization success. However, it is more likely that this approach will lead to uncertainty and discontent within the organisation along with high costs. Employees refuse to deal with the issue, block it to protect their own position and barely cooperate. Urgently needed digitization of the enterprise grinds to a standstill.

With the help of 5 simple principles, it is possible to quickly and simply move digital change within banks forward:

- CEO’s don’t need to understand digitization

CEOs and Board Directors do not necessarily have to understand digitization. In any case, they usually don’t (https://www.der-bank-blog.de/bankvorstaenden-fehlt-digitales-know-how/studien/technologie-finance/20430/ ). The CEO or Board of Directors must give the mandate for digitization, but not necessarily take a hands-on role in its implementation or be able to participate in its ecosystem. They should trust the contractor.

- Digitization strategy is for freaks

The digitization strategy must be understood by those who have been directly entrusted with implementing projects within the framework of this strategy. The freaks, who are familiar with the subject, have been assigned to the project. These people who are established in this field, feel at home here or simply have a passion for it. Other keywords, such as Industrie 4.0, Fintech, E-Government, Multichannel, Cloud etc. are unclear, confusing and incomprehensible to everyone else. It is also not uncommon for them to feel insecure, which is undesirable.

- Influencing corporate culture

Corporate culture does not have to be digitally-oriented as a precondition for starting a digitization project. Apple never consulted us about their product evolution (iPhone, tablets). Also, the internet never asked mankind in advance whether we were ready for it. Corporate culture is automatically enhanced by the implementation of the digital projects, step by step.

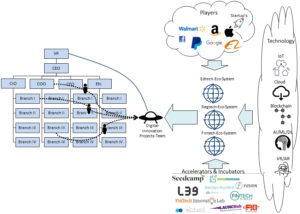

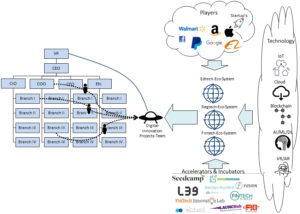

- Implementing digital projects through “UFO” organization

Project managers should be accountable for the implementation of the digitization strategy and its corresponding projects. No-one should be able to oppose the plans. In so far as possible, such projects should not influence existing day-to-day operations of the business (no matrix organisations). This leads to a “UFO organization”. UFO organization? Maybe you have heard of digitization – some believe in it, others not. But once you have actually experienced the digitization process, you become a believer in both the project and its intended purpose. Just like a UFO. You only accept it if you believe in it. If not, hardly anyone cares.

Figure: Eco-System and UFO-Organisation

Advantages:

- Project staff are engaged 100% to the project (minimizes conflicts of interest)

- It is sanctioned directly from the “highest” authority (CEO or BoD issues the order to implement the digital strategy)

- New opportunities open up for employees

- Project team members become ambassadors of the digitalization process.

- No initial troublesome and costly cultural change required

- The business can continue to focus 100% on its work

- Projects can be started and stopped easily (existing organization is not affected)

- No escalation steps exist -> UFO-organizations are directly connected to the highest decision-making authority so projects are “politically” difficult to stop.

Disadvantages:

- The reintegration of project employee can lead to unrest (employees do not want to return to their previous position; unrest due to newly created digitization know-how etc.)

- Good “little hand” in the selection of personnel

As is so often the case, a successful project stands and falls by the resources involved. Surely, the project staff must be 100% freed up from day-to-day duties. Above all, each project team member should be fully committed to the project.

In addition, the UFO organization needs to fill specific positions from outside the business. Such people should have appropriate networks, know-how and, last but not least, a feeling for tall this so that they can test and evaluate the various parts of the ecosystem on a regular basis or when a situation demands it. It is not easy to find/identify such people (https://dupress.deloitte.com/dup-us-en/focus/human-capital-trends/2017/developing-digital-leaders.html ). They are in demand and will become more and more so. So-called digital-leaders (for example in Blockchain as described here https://www.linkedin.com/pulse/blockchain-leadership-how-technology-calls-next-leaders-schoeni/).

Often several digital leaders are needed, as only rarely does one person cover all the bases. Digital leaders come with a deep network in their respective ecosystems and are familiar with the relevant technologies. They also have strong technical know-how of the relevant business sectors and well-developed project management skills. This new profile of specific requirements has so far been difficult to find in the digitization space. Several universities have addressed the issue and are attempting try shift resources to meet this need (e. g. HWZ https://fh-hwz.ch/produkt/cas-digital-leadership/)

Conclusion:

There is no need to initiate cultural change or organizational adjustments to an institution and its processes to make the leap into the digital age. It needs a dedicated “UFO unit, equipped with the best possible skills and resources with freedom to operate. Digital leaders can then focus the concentrated power of digital know-how, in a situational and targeted way, to implement digitization in the company step by step.

by ndwr | Sep 28, 2017 | Blog

What is PSD2?

With the revised, i.e. second Payment Services Directive (PSD2) adopted in October 2015, the EU wants to make payment transactions on the Internet more convenient, cheaper and safer.

The EU wants to promote competition in the payment system and standardize the payment products by standardizing the rules for banks and payment service providers. PSD2 help to ensure transparency and fair competition and reduce the entry barriers for new payment services – all for the benefit of the customer.

The Directive requires that all Member States implement these rules as national law by 13 January 2018.

What is the expected impact?

Read full article here

Is PSD2 secure enough?

Read full article here

What does PSD2 mean for banks?

Read full article here

In Zusammenarbeit mit CREALOGIX und Fintechrockers wollen wir einem kleinen Kreis von MachernInnen aus der Finanzindustrie eine Plattform bieten, ihre digitalen Initiativen einem konstruktiv-kritischen Reality-Check zu unterziehen. Das intensive aber abwechslungsreiche Programm beginnt in der Heimat mit einer Briefing-Session, wo erfahrene Crealogen individuell mit den TeilnehmerInnen die Schwerpunkte der Reise ausloten und quasi ‚den Schwamm anfeuchten’. Ein feuchter Schwamm saugt besser als ein trockener, wie wir aus der Physik wissen.

In Zusammenarbeit mit CREALOGIX und Fintechrockers wollen wir einem kleinen Kreis von MachernInnen aus der Finanzindustrie eine Plattform bieten, ihre digitalen Initiativen einem konstruktiv-kritischen Reality-Check zu unterziehen. Das intensive aber abwechslungsreiche Programm beginnt in der Heimat mit einer Briefing-Session, wo erfahrene Crealogen individuell mit den TeilnehmerInnen die Schwerpunkte der Reise ausloten und quasi ‚den Schwamm anfeuchten’. Ein feuchter Schwamm saugt besser als ein trockener, wie wir aus der Physik wissen.